Understanding Gross vs. Net Profit Margin

- Irvine Bookkeeping

- Jan 2

- 4 min read

Profit margin is the percentage of revenue that remains as profit after all expenses are deducted. It’s a clear indicator of a company’s profitability and operational efficiency.

For example, if your profit margin is 20%, it means you retain $0.20 as profit for every $1 of revenue generated. The higher your profit margin, the more efficiently your business operates.

Profit margin can be broken into three main types:

Gross Profit Margin: Focuses on profit after accounting for the cost of goods sold (COGS).

Operating Profit Margin: Considers operating expenses like rent, utilities, and salaries.

Net Profit Margin: Reflects the overall profitability after all expenses, taxes, and interest.

How to Calculate Profit Margin

The formula for profit margin is straightforward:

For specific types of profit margin:

Gross Profit Margin:

Operating Profit Margin:

Net Profit Margin:

Example: Calculating Profit Margin

Let’s say your business reports the following for a month:

Revenue: $50,000

COGS: $20,000

Operating Expenses: $15,000

Net Income: $10,000

Gross Profit Margin

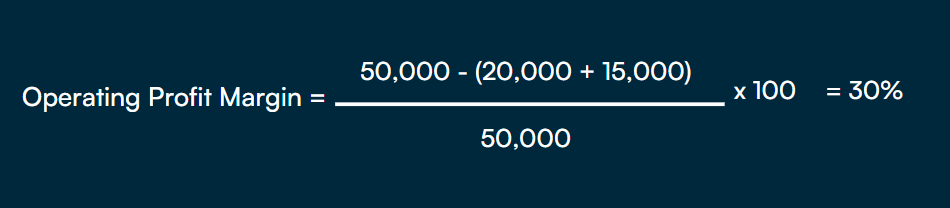

Operating Profit Margin:

Net Profit Margin:

These calculations reveal how much profit you retain at each stage of expense deduction.

Why is Profit Margin Important?

Measure Financial Health:Profit margin provides a snapshot of how well your business converts revenue into profit, making it a critical measure of efficiency.

Compare Performance:Comparing your profit margin to industry averages or competitors helps gauge how well your business is performing.

Make Strategic Decisions:Profit margins guide decisions on pricing, cost-cutting, and resource allocation.

Attract Investors:A healthy profit margin demonstrates profitability and operational efficiency, making your business attractive to investors and lenders.

Net Profit Margin vs. Gross Profit Margin

Net Profit Margin

Net profit margin gives you a comprehensive view of how profitable your entire business is after accounting for all expenses—both direct (e.g., cost of goods sold) and indirect (e.g., rent, salaries, taxes, and interest). This metric tells you how much of every dollar earned is retained as profit.

Key Use Case:If you want to understand your business's overall financial health, including how efficiently it manages both production and operational costs, net profit margin is the go-to metric.

Example:For a coffee shop, net profit margin considers not just the costs of coffee beans and cups but also rent, software subscriptions, and employee wages. It provides a broader picture of profitability and operational efficiency.

Gross Profit Margin

Gross profit margin focuses specifically on the profitability of your products or services by deducting only direct costs (COGS) from revenue. It shows how effective your pricing strategy is and how well your products or services generate profit without factoring in operational costs.

Key Use Case:Use gross profit margin to assess whether your pricing strategy is sufficient to cover your production costs and contribute to overall profitability.

Example:For the same coffee shop, gross profit margin reveals how much profit is made per cup of coffee sold after accounting for the costs of coffee beans and cups. However, it doesn’t consider rent or other operating expenses.

Common Mistakes to Avoid

Neglecting All Types of Profit Margins:Focusing solely on net profit margin without considering gross and operating margins can lead to incomplete analysis.

Ignoring Industry Benchmarks:Comparing your profit margin only to your past performance without considering industry averages may give a false sense of success.

Overlooking Hidden Costs:Costs like shipping fees or equipment depreciation, if ignored, can distort your profit margin.

How to Use Profit Margin in Real Life

Now that you understand how to calculate profit margins, here’s how to use them effectively in your business:

Evaluate Cost EfficiencyIf your gross profit margin is healthy but your net profit margin is low, it’s a signal to review operating expenses. High overhead, like rent or administrative costs, might be eating into your profits. Identifying and reducing unnecessary costs can help boost your net profit margin.

Guide Strategic DecisionsBy comparing gross and net profit margins, you can decide where to focus your efforts:

If your gross margin is low, consider adjusting pricing or reducing production costs.

If your net margin is low but gross margin is strong, focus on reducing operating expenses.

Attract Investors and LendersA healthy net profit margin demonstrates financial stability, making your business more appealing to investors and lenders. For example, an investor may prefer a business with a consistently improving net profit margin as it shows long-term profitability and efficiency.

Monitor Financial HealthProfit margins serve as early warning signs for financial issues. If your net profit margin starts to decline, it may indicate rising costs or shrinking revenues. Acting quickly to identify and address the cause can prevent larger financial problems.

How Irvine Bookkeeping Can Help

Profit margins are vital for your business’s success, but calculating and analyzing them can be time-consuming. At Irvine Bookkeeping, we help mid and small size firms track revenues, expenses, and profit margins with precision. Our expert bookkeeping services simplify your finances so you can focus on growing your business.

Kommentare