Best Balance Sheet Bookkeeping Software Ranked

- Irvine Bookkeeping

- 4 days ago

- 6 min read

Hey there, fellow business owner! If you’re like me, you’ve probably spent more than a few late nights puzzling over spreadsheets, trying to make sense of your company’s balance sheet. It’s that critical document showing what you own, what you owe, and what’s left over—your financial heartbeat. But let’s be real: managing it manually is a headache. That’s where balance sheet software comes in, and today, I’m ranking the best bookkeeping software to help you take control of your finances with ease.

As someone who’s been in the trenches of running a business, I get it—finding the right tools can feel overwhelming. You want software that’s accurate, user-friendly, and doesn’t break the bank. In this article, I’ll walk you through the top balance sheet software options, ranked based on features, usability, and value. We’ll dig into what makes them stand out, answer your burning questions, and share practical tips to streamline your bookkeeping.

Why Balance Sheet Software Matters for Your Business

First things first: why should you care about balance sheet software? Your balance sheet isn’t just a report—it’s a window into your business’s health. It tracks assets (like cash and inventory), liabilities (debts and bills), and equity (what’s left for you). Mess it up, and you could misjudge your cash flow, scare off investors, or even trip over tax rules.

Manual bookkeeping works when you’re small, but as your business grows, so does the complexity. That’s where the best bookkeeping software saves the day. It automates calculations, catches errors, and keeps your balance sheet accurate—leaving you more time to focus on what you love: running your business.

If so, you’re not alone! Tons of business owners start there. But software can cut your workload in half—trust me, I’ve been there.

Ranking the Best Balance Sheet Bookkeeping Software

Here’s my rundown of the best bookkeeping software for managing your balance sheet, ranked from top to bottom. I’ve tested these tools, talked to other business owners, and factored in cost, features, and ease of use. Let’s break it down!

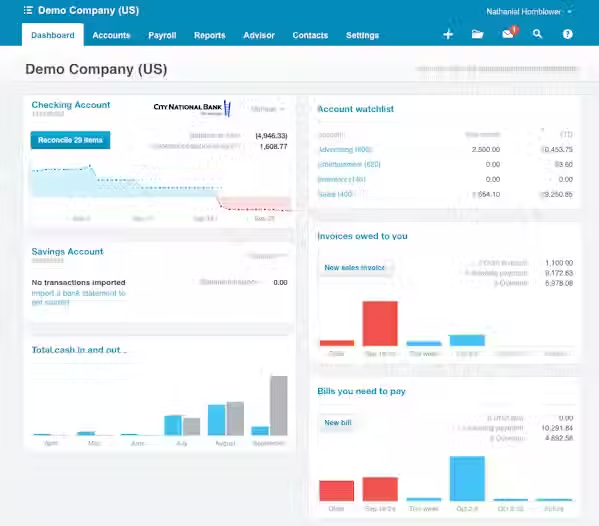

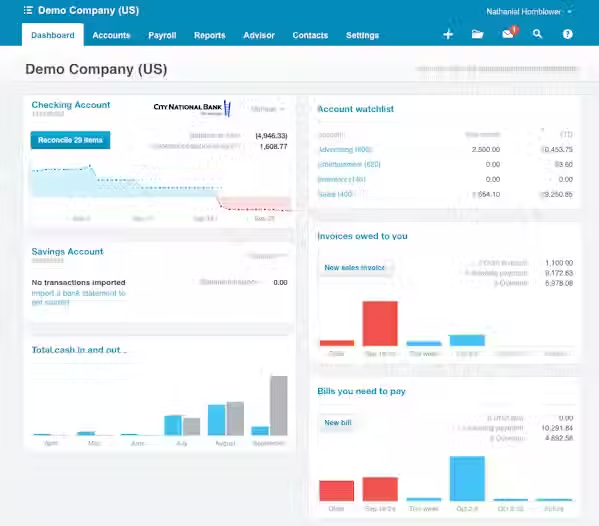

1. QuickBooks Online: The All-Star Performer

Why First is: There's a reason why QuickBooks Online is the industry standard. With its many features, including real-time updates, editable templates, and smooth connectivity with your bank accounts, it makes reporting a breeze.

Important attributes: provides more than 50 financial reports, records assets and obligations, and automatically creates balance sheets.

Ideal For: Full-suite solutions for small to mid-sized organizations.

Cost: Starts at $30/month (Simple Start plan).

For instance: Consider yourself a store who has a $20,000 loan and $50,000 in goods. In only a few minutes, QuickBooks extracts those figures, compares them to your cash, and generates a clear balance sheet.

Tip: Sync your bank accounts to avoid manual entry errors—it’s a game-changer for balance sheet accuracy.

2. Xero: The User-Friendly Contender

Why It’s Great: Xero excels thanks to its robust balance sheet management and user-friendly UI. You can check your finances from anywhere because it's cloud-based.

Key Features: include comprehensive balance sheet reporting, automated reconciliations, and interfaces with more than 1,000 apps.

Ideal For: Companies seeking power without compromising simplicity.

Cost: Starts at $15/month (Early plan).

For instance, Xero can be used by a consultant who has variable client payments to monitor receivables on their balance sheet and make sure they are aware of the precise amount owed.

Tip: Use Xero’s mobile app to snap receipts on the go—keeps your balance sheet data current.

3. FreshBooks: The Service Business Champ

Why It Ranks: A popular choice for service-based enterprises is FreshBooks. It emphasizes tracking expenses and creating invoices, and its balance sheet features are simple.

Key Features: Time tracking, double-entry bookkeeping, and balance sheet production are important features.

Best For: Freelancers and service firms needing light balance sheet management.

Cost: Starts at $19/month (Lite plan).

For instance, in one location, a graphic designer can record billable hours, link them to project expenses, and observe how they affect the balance sheet.

Tip: Set up recurring invoices to keep cash flowing and your balance sheet healthy.

4. Wave: The Budget-Friendly Pick

Why It’s Here: Even though Wave is free, it still has good functionality for balance sheet software. If you're just getting started, it's ideal..

Key Features: monitoring income and expenses, scanning receipts, and basic balance sheet reporting.

Best For: Startups and solopreneurs on a tight budget.

Cost: Free (premium add-ons like payroll cost extra).

For instance, a food truck owner can create a basic balance sheet without investing any money by using Wave to keep track of daily sales and supplier debts.

Tip: Upgrade to paid features like bank imports if your transactions pile up—keeps balance sheet accuracy on point.

5. Zoho Books: The Customizable Sleeper Hit

The Reason for Its Ranking: With a unique twist—a great deal of customization—Zoho Books provides powerful balance sheet features. It grows with you because it is a component of a larger business suite.

Key features: inventory monitoring, multi-currency support, and balance sheet customisation.

Best For: Expanding companies that require adaptability.

Cost: Starts at $20/month (standard plan).

For instance, an online retailer that works with foreign vendors might adjust Zoho's balance sheet to account for changes in exchange rates and inventory expenses.

Tip: Link Zoho Books with Zoho CRM to tie sales data to your balance sheet—super handy for forecasting.

What to Look for in Balance Sheet Software

Not sure which best bookkeeping software fits your needs? Here’s what I’ve learned matters most:

Ease of Use: You don’t need a CPA to run it. Look for clean interfaces and guided setups.

Balance Sheet Features: Auto-calculations, report templates, and real-time updates are must-haves.

Integration: It should sync with your bank, payroll, and tax tools.

Cost: Match the price to your budget—free options like Wave work if you’re lean.

Support: Live chat or phone help can save you when you’re stuck.

Read More: Balance Sheet vs Profit & Loss Account

Common Questions About Balance Sheet Software

Let’s tackle some questions you might have about picking the best bookkeeping software for your balance sheet.

Q: Can I manage my balance sheet without software?

Yes, you can, but it would be like using scissors to mow a grass. For small enterprises, manual procedures are effective, but mistakes quickly occur. Software saves you time and guarantees the accuracy of your balance sheet.

Q: How often should I update my balance sheet?

Monthly is ideal. It keeps you on top of cash flow and debt. Most balance sheet software updates automatically with bank feeds, so it’s low effort.

Q: Will this software help with taxes?

Of course! Your tax filings are supported by a sound balance sheet. Tax season is made less harsh by programs like Xero and QuickBooks, which even export data for your accountant.

Q: Is free software good enough?

For startups, yes—Wave’s a gem. But as you grow, paid options with advanced balance sheet tools (like inventory tracking) become worth it.

Tips to Maximize Your Balance Sheet Software

Here’s how to get the most out of your chosen best bookkeeping software:

Reconcile Regularly: To identify inconsistencies, compare the data in your software with bank statements once a month.

Categorize Everything: Accurately classifying your revenue and expenses is essential to the accuracy of your balance sheet.

Run Reports Often: Don't leave it alone. To identify trends, review your balance sheet once a week.

Train Your Team: Make sure your employees are familiar with the system; less errors translate into cleaner books.

Backup Data: Xero and other cloud-based apps automatically store data, but you should export important reports just in case.

For instance, a café owner I know reconciles daily sales using QuickBooks. They discovered a $500 mistake in supplier payments one month and corrected it before it appeared on the balance sheet.

DIY Bookkeeping vs. Hiring Help

Without a doubt, you are capable of handling your own balance sheet program. Start by selecting one from this list, synchronizing your bank, and creating your accounts. To stay on track, enter transactions for 15 minutes each day and generate a balance sheet report once a week. Even if you're not good at accounting, you can still succeed!

The worst part is that time becomes your most valuable resource as your company expands. Irvine Bookkeeping can help with that. We are proficient in managing balance sheets for small and medium-sized businesses using premium programs like Xero and QuickBooks. While you concentrate on growing your company, we handle the tedious tasks and guarantee balance sheet correctness.

Comments