WHAT YOU NEED TO KNOW ABOUT DOUBLE ENTRY BOOKKEEPING

- David Wang

- Oct 26, 2015

- 2 min read

Updated: Mar 13, 2024

The double entry bookkeeping system is based upon the fact that every transaction has two parts and that this will therefore affect two ledger accounts.

Every transaction involves a debit entry in one account and a credit entry in another account. This means that every transaction must be recorded in two accounts; one account will be debited because it receives value and the other account will be credited because it has given value.

The rule to remember is "debit the receiver and credit the giver".

In the ledger

Whether hand written or computerized, the ledger contains accounts of each asset and liability of the business and of the capital (amount invested) of the owner, and a separate account is kept for every item in which a business deals.

For Every Transaction: The Value of Debits must = The Value of Credits

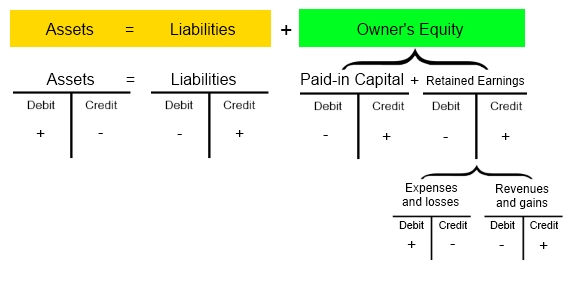

The extended accounting equation must balance:

'A + E = L + OE + R'

(where A = Assets, E = Expenses, L = Liabilities, OE = Owner's Equity and R = Revenues)

So, therefore, 'Debit Accounts (A + E) = Credit Accounts (L + R + OE)'. Debits are on the left and increase a debit account and reduce a credit account. Credits are on the right and increase a credit account and decrease a debit account.

Every account has two "sides", a right side and a left side. A debit refers to an entry on the left side of an account, and a credit refers to an entry on the right side of an account.

Double entry bookkeeping requires that for every transaction, there is an entry to the left side of one (or more) account, and a corresponding entry to the right side of another account(s).

Expenses are always debits

Revenues are always credits

Debit the Cash account when cash is received

Credit the Cash account when cash is paid out

Bookkeeping in e-conomic

In the e-conomic Accounting System, you can use the "bookkeeping" tab to enter customer receipts, create new suppliers, and enter their invoices, payments, and remittance advice or use bookkeeping services to do it. You can also create recurring journal entries such as standing orders and direct debits, which can then be booked each month and saved in the system for the next month.

We provide Bookkeeping services across regions in the USA. Professional bookkeeping team and knowledgeable about accounting of specific areas from large areas such as Bookkeeping Los Angeles to other areas

View Our Bookkeeping Services here!

Call Irvine Bookkeeping services today if you have any questions regarding the statement of cash flows. You reach us at 949-545-9980 or visit us at www.irvinebookkeeping.com